lincoln ne sales tax 2019

What is the sales tax rate in Lincoln Nebraska. Form 4797N 2019 Special Capital Gains Election and Computation.

ACT is hosting the meetings to focus on new street work to be funded by the quarter-cent sales tax approved by voters in April.

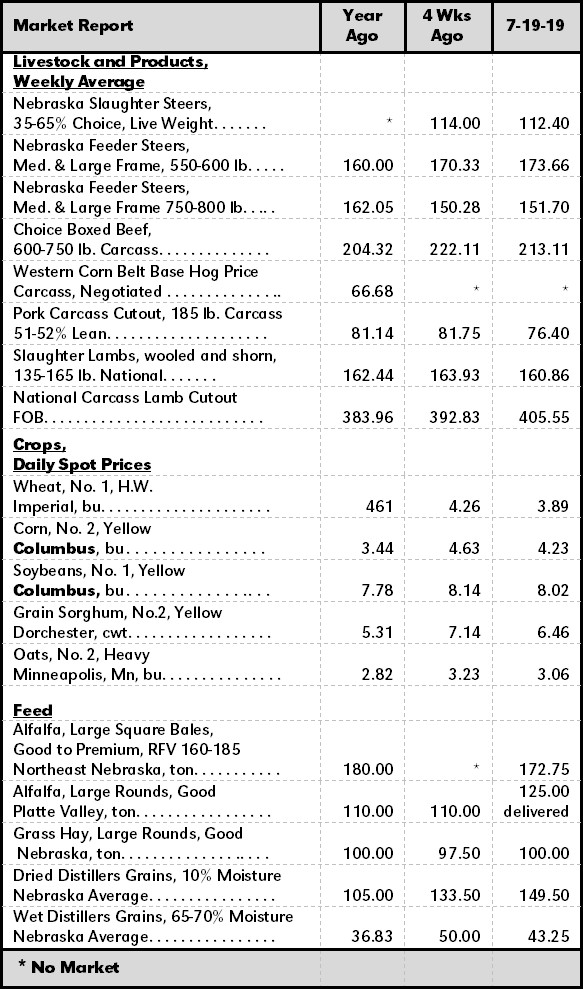

. Sales taxes are 29 of total tax collections and income taxes are 26. FilePay Your Return. The Nebraska state sales and use tax rate is 55 055.

Diane Gonzolas City Communications 402-441-7831. For tax rates in other cities see Nebraska sales taxes by city and county. The minimum combined 2022 sales tax rate for Lincoln Nebraska is.

Nebraska is giving online businesses until 2019 to start collecting sales taxes on orders placed within the state. Trained volunteers are sent by VITA and AARP. 150 - State Recreation Road Fund - this fee.

You can print a 725 sales tax table here. Form CDN 2019 Nebraska Community Development Assistance Act Credit Computation. AP - Nebraska is giving online businesses until 2019 to start collecting sales taxes on orders placed within the state.

Additional fees collected and their distribution for every motor vehicle registration issued are. Skip to main content. This property has a lot size of 035 acres.

The Nebraska sales tax rate is currently. In Lincoln another 15 percent or one and a. In April 2019 the City of Lincoln voters approved a six-year 14 cent sales tax to be used for street improvements and construction.

Supreme Court ruling that gave states the authority to. The state sales tax rate stands at 55 percent or around five and a half cents for ever dollar spent. Form 2441N - Nebraska Child and Dependent Care Expenses.

A no vote was a vote against authorizing the city to increase the local. Of this new revenue to be collected starting October 1 2019 a minimum of 25 must be apportioned to construction of new non-residential streets to promote private investment. If property taxes sales taxes and income taxes were equalized as sources of state and local revenue property taxes would need to be reduced over 600 million.

Ordinances 2999-17 and 3005-18. A yes vote was a vote in favor of authorizing the city to increase the local sales tax by an additional 025 percent a quarter cent for six years to fund street improvements. Form 3800N - Nebraska Employment and Investment Credit Computation for All Tax Years.

800-742-7474 NE and IA. The Nebraska state sales and use tax rate is 55 055. Lincoln City Libraries provides the space for this service.

The description and property data below may have been provided by a third party the homeowner or public records. The filing deadline for this election was March 7 2019. The Lincoln sales tax rate is.

This lotland is located at 2019 North St Lincoln NE. For city sales and use tax purposes only these boundary changes are effective on the date identified in the column titled Effective Date. It was approved.

Tax Commissioner Tony Fulton announced the following changes in local sales and use tax rates for the upcoming quarter starting on April 1 2019. Library staff are not authorized to provide assistance or advice regarding Income Tax preparation. Ordinances 20579 20586 and 20718.

In year one FY 19-20 the proposed. Lincoln City-Lancaster County Planning Department Sales Tax Funds for New Street Construction Proposed Strategy August 26 2019 _____ The following is a proposed strategy from the Lincoln Transportation and Utilities Department and the Planning Department for use of the quarter cent sales for new street construction. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount.

The Department of Revenue announced Friday that so-called remote sellers must obtain a sales tax permit and begin collecting the tax by Jan. Although candidates had the option to file with political parties city. The December 2020 total local sales tax rate was also 7250.

Potential Use of Quarter Cent Sales Tax for New Construction to Promote Private Sector Investment Draft as of August 26th 2019 Legend Annexation Agreements. A primary was scheduled for April 9 2019. The decision follows a US.

September 16 2019 Media Contact. Volunteer Income Tax Assistance was provided only through. There are no changes to local sales and use tax rates that are effective July 1 2022.

The city of Lincoln Nebraska held general elections for mayor city council Districts 1 2 3 and 4 and one of five elected seats on the airport authority on May 7 2019. 2019 North St is in the Downtown neighborhood in Lincoln NE and in ZIP code 68510. Potential Funding Examples of Additional Potential Projects µ 0 05 1 2 Miles Document Path.

There are no changes to local sales and use tax rates that are effective January 1 2022. This is the total of state county and city sales tax rates. The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax.

The County sales tax rate is. A sales tax measure was on the ballot for Lincoln voters in Lancaster County Nebraska on April 9 2019. 200 - Department of Motor Vehicles Cash Fund - this fee stays with DMV.

025 lower than the maximum sales tax in NE. Did South Dakota v. Effective April 1 2022 the city of Arapahoe will increase its rate from 1 to 15.

The state sales tax rate in Nebraska is 55 but you can customize this table as needed to reflect your applicable local sales tax rate. Lincoln NE Sales Tax Rate The current total local sales tax rate in Lincoln NE is 7250. AP Nebraska is giving online businesses until 2019 to start collecting sales taxes on orders placed within the state.

Property taxes account for 38 of total state and local tax collections in Nebraska the highest of any tax. 50 - Emergency Medical System Operation Fund - this fee is collected for Health and Human Services. More information is available at streetslincolnnegov.

There is no applicable county tax or special tax. Income Tax Assistance is available at Lincoln City Libraries during tax season. Wayfair Inc affect Nebraska.

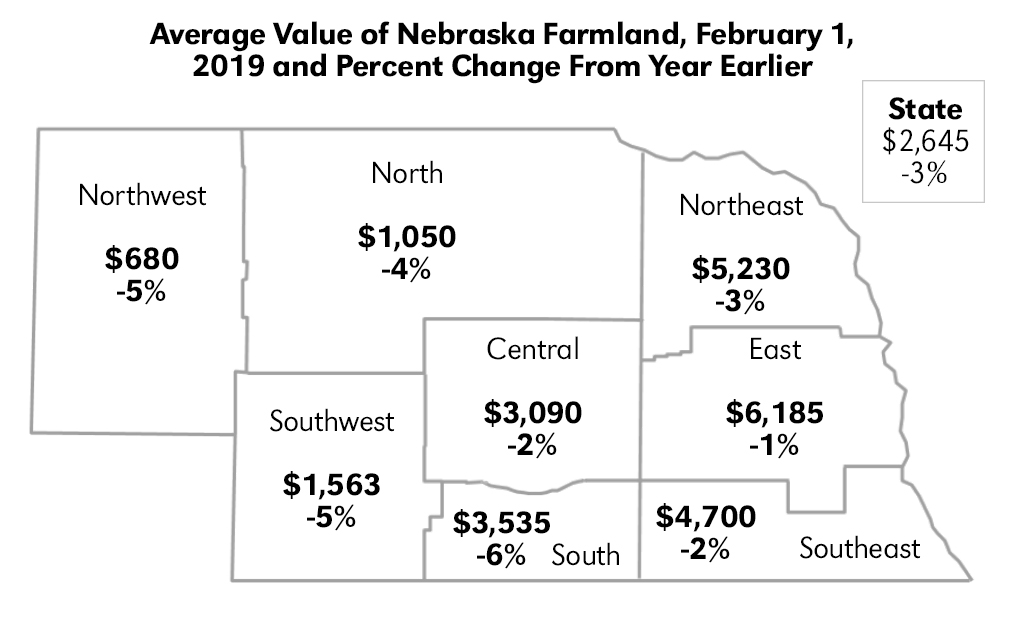

2019 Nebraska Property Tax Issues Agricultural Economics

Vehicle And Boat Registration Renewal Nebraska Dmv

Used One Owner 2019 Ford Fusion Se In Randolph Oh Sarchione Auto Group

Vin 1ft8w3b69ked58952 Used 2019 Ford F 350 For Sale At Tasca Automotive Group

Pre Owned 2019 Gmc Yukon Slt 4d Sport Utility For Sale Kr220746p Principle Auto

2019 Audi A4 Values Cars For Sale Kelley Blue Book

Pre Owned 2019 Toyota Tacoma Trd Sport 4 4 Trd Sport 4dr Double Cab 5 0 Ft Sb 6a In Roanoke Cj25340b Berglund Chevrolet Buick

10136 Queensland Rd West Des Moines Ia 50266 Mls 600593 Zillow Ranch Homes For Sale House Colors Hardy Plank Siding

Today S Ljs Is The Last Edition Printed In Lincoln Endofanera Signsofprogress Star Signs Instagram Prints

2019 Nebraska Farm Real Estate Report Agricultural Economics

Certified Pre Owned 2019 Chevrolet Colorado 4wd Zr2 Crew Cab In Fremont 1t8858g Sid Dillon

Pre Owned 2019 Jeep Wrangler Unlimited Sahara Convertible In Bellevue 23614a Land Rover Bellevue

Pre Owned 2019 Bmw X3 M40i Xdrive Awd Sport Utility In Miami Gardens B355962 Off Lease Only

Anatomy Of An Artwork Untitled I Shop Therefore I Am 1987 2019 By Barbara Kruger Art For Sale Artspace

Used 2019 Jeep Wrangler Unlimited 4 Door Maquoketa L Quad Cities Iowa 1c4hjxen3kw514003